"Bernie Madoff had my money. What do I do?

Bernie Madoff has apparently perpetrated the largest Ponzi scheme in history, swindling investors out of more than $50 billion. The enormity of the losses and the tragic outcomes for many of the victims will probably make him the poster child for the economic upheaval in 2008 in the months and years to come.

People invested with Madoff in many ways - some directly, and others through intermediaries that included many of the most respected money managers and hedge fund operators around. The big question for victims is, "how do I recover?" The answer to that question depends on how the investor got into the fund in the first place, and the kind of due diligence he or his trusted intermediary performed.

There were red flags

Madoff seem to have hidden his alleged crimes from everyone, but there were numerous red flags. The most obvious was the attractiveness of Madoff's returns which he offered or even guaranteed through good and bad markets. The fact that no one could duplicate how he made the money or actually understood his complicated option schemes raised concern among some savvy individuals but they were largely ignored as the good times rolled on.

It seems odd that financial intermediaries who spend large sums of money on the best auditors would dismiss Madoff's obscure one-man audits. Yet, we've seen this before in one of Connecticut's recent hedge fund scams, the Bayou Fund, whose principals apparently fabricated its auditing firm and its audits. While many people justifiably look at the failures of the United States Securities and Exchange Commission and other regulators and ask "why didn't they pursue their investigation of Madoff more vigorously?" similar questions may be asked about the intermediaries, many with fiduciary obligations to the investors, who also seemed to be wooed by the siren song of consistent returns.

What do I do now?

Some investors may find comfort in the Securities Investor Protection Corporation, SIPC, which insures securities brokerage accounts, but functions less like the FDIC than like bankruptcy court. Generally, brokerage accounts are insured to a maximum of $500,000. If there was an account existing on the books of Bernard L. Madoff Investment Securities, LLC there may be recovery through SIPC; however, SIPC claims are restricted to "customers" of the broker-dealer. Certainly if a victim received a monthly statement or confirmations of securities transactions from the broker-dealer, that information would help prove that he was a customer. However, Madoff victims who invested though third parties such as a hedge fund of funds or other intermediary will not be listed as customers of the broker-dealer. This is the more likely scenario.

If a victim looks to the intermediary hedge fund, investment adviser, or other Madoff fund raiser, will there be any way to recover from those entities or individuals? The answer is "maybe." Some did nothing but follow the orders of their clients to transfer their funds to Madoff or other intermediaries. Others brought Madoff investments to their clients and then sold them on the idea. Fund of funds managers may not have even told their limited partners or members that they were investing in the Madoff funds.

There are reports that some Madoff investors surmised that he was running a fraudulent scheme but guessed wrong about the fraud. They believed that he was getting inside information about the securities in which he made markets and they figured that he had better information than they did and wanted to capitalize on his wrongdoing for their own benefit. If these investors used other people's money to follow what they thought was Madoff's scheme, they certainly could be liable in actions brought by their own investors or clients.

Will the victims recover some or all of their losses?

Again, the answer is "maybe." The reason that class action lawyers have been slow to file actions here is that almost every case is different. The ability to recover will be based on the status of a victim as a broker-dealer customer; the fiduciary nature and responsibility of the intermediary; whether the intermediary has enough funds or insurance to pay even if they are found liable for negligence or breach of fiduciary duty; and even the ability of the victim to bring some kind of legal action himself or herself. There will be lots of different Madoff-related cases, particularly after the SEC or other regulators bring actions. A qualified securities lawyer can help Madoff investors review the options as they apply to their particular case.

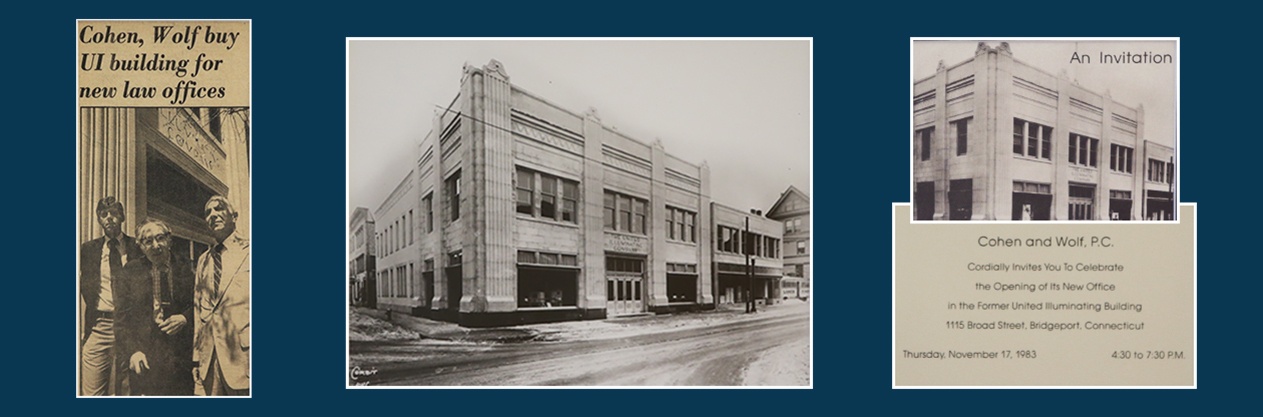

Attorney Richard Slavin is the Managing Partner of Cohen and Wolf's Westport office. He has years of experience in private practice and as a securities regulator. He has represented both broker-dealers and customers in securities arbitrations and has been a securities and commodities arbitrator since 1985. He frequently writes and lectures on securities law. Mr. Slavin can be reached at: rslavin@cohenandwolf.com or (203) 222-1034.

Practice Areas

Attorneys

- Principal